Quick answer: No, 529 contributions are not deductible on your federal tax return. However, more than 30 states offer a state income tax deduction or credit for 529 plan contributions. Your state tax benefit depends on where you live and which plan you choose.

Many states offer state income tax deductions or credits for contributions to a 529 plan. Your 529 state tax deduction amount will depend on where you live and how much you contribute to a 529 college savings plan during a given tax year.

Are 529 contributions tax-deductible on federal taxes?

No. 529 plan contributions are not deductible on your federal income tax return. This applies to all taxpayers regardless of which state’s 529 plan you use or how much you contribute.

However, 529 plans still offer significant federal tax benefits: earnings grow federally tax-free, and withdrawals for qualified education expenses are not subject to federal income tax.

Do any states offer tax deductions for 529 contributions?

Yes. More than 30 states—including Washington, D.C.—offer a state income tax deduction or credit for 529 plan contributions. In most cases, you’ll need to contribute to your own state’s plan to receive the tax benefit.

The amount you can deduct varies by state, ranging from a few thousand dollars to unlimited deductions in states like New Mexico, South Carolina, and West Virginia.

What are the tax benefits of a 529 plan?

529 plans allow account owners, friends, and family to contribute to higher education savings with after-tax income and enjoy two types of potential tax benefits:

Federal tax benefits

529 plan contributions grow federally tax-free, and earnings are not subject to federal income tax when you take withdrawals for qualified education expenses. This includes:

- College tuition, fees, books, and room and board

- Up to $10,000 in K-12 tuition expenses in 2025 (increasing to $20,000 starting in 2026)

- Up to $10,000 in student loan payments (lifetime limit)

Note that there is no federal income tax deduction on 529 plan contributions.

State tax benefits

Most states with income taxes allow either a deduction from income or a state tax credit for 529 plan contributions when reporting income for state tax purposes. Most states also allow any contributor, not just the account owner, to claim the applicable tax benefits on their tax return.

However, not all states follow the federal tax treatment of K-12 tuition or student loan expenses.

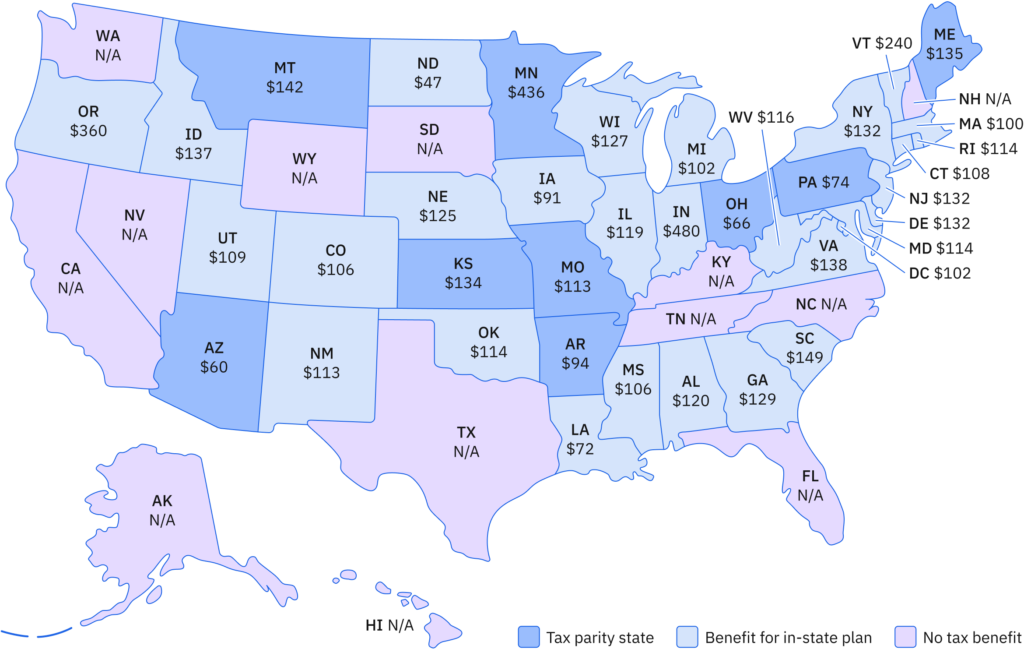

Which states offer tax benefits for 529 contributions?

As mentioned, most states offer a state income tax deduction or tax credit for 529 plan contributions.

Additionally, nine tax parity states offer a state income tax benefit for contributions to any 529 plan, not only in-state plans:

States offering tax credits vs. deductions

In most states, the total amount or a portion of a taxpayer’s 529 plan contribution is deductible when computing state income tax. However, Indiana, Oregon, Utah, and Vermont offer a state income tax credit for 529 plan contributions. Minnesota taxpayers are eligible for a state income tax deduction or credit depending on their adjusted gross income.

States without 529 tax benefits

Four states currently have a state income tax but do not offer a contribution deduction: California, Hawaii, Kentucky, and North Carolina.

How much can you save with state tax deductions?

The table below shows estimated annual tax savings by state, along with whether each state offers tax parity (allowing deductions for any state’s 529 plan):

State |

Potential annual tax savings |

Tax parity state? |

AL |

$120 |

No |

AK |

N/A |

N/A |

AZ |

$60 |

Yes |

AR |

$94 |

Yes |

CA |

N/A |

N/A |

CO |

$106 |

No |

CT |

$108 |

No |

DE |

$132 |

No |

DC |

$102 |

No |

FL |

N/A |

N/A |

GA |

$129 |

No |

HI |

N/A |

N/A |

ID |

$137 |

No |

IL |

$119 |

No |

IN |

$480 |

No |

IA |

$91 |

No |

KS |

$134 |

Yes |

KY |

N/A |

N/A |

LA |

$72 |

No |

ME |

$135 |

Yes |

MD |

$114 |

No |

MA |

$100 |

No |

MI |

$102 |

No |

MN |

$436 |

Yes |

MS |

$106 |

No |

MO |

$113 |

Yes |

MT |

$142 |

Yes |

NE |

$125 |

No |

NV |

N/A |

N/A |

NH |

N/A |

N/A |

NJ |

$132 |

No |

NM |

$113 |

No |

NY |

$132 |

No |

NC |

N/A |

N/A |

ND |

$47 |

No |

OH |

$66 |

Yes |

OK |

$114 |

No |

OR |

$360 |

No |

PA |

$74 |

No |

RI |

$114 |

No |

SC |

$149 |

No |

SD |

N/A |

N/A |

TN |

N/A |

N/A |

TX |

N/A |

N/A |

UT |

$109 |

No |

VT |

$240 |

No |

VA |

$138 |

No |

WA |

N/A |

N/A |

WV |

$116 |

No |

WI |

$127 |

No |

WY |

N/A |

N/A |

ScrollSwipe to see full table

Note: “N/A” indicates states with no state income tax or no 529 tax benefit. Actual savings depend on your contribution amount, tax bracket, and state-specific deduction limits. States with “Yes” in the Tax Parity column allow deductions for contributions to any state’s 529 plan.

Use this calculator to estimate the value of your personal tax benefit:

How do 529 state tax deductions and credits work?

State income tax benefits are based on the amount of a taxpayer’s total 529 plan contributions in a given tax year. While no annual contribution limits exist for 529 plans, most states limit the total contributions that qualify for an income tax credit or deduction.

State deduction limits vary widely

For example, New York residents are eligible for an annual state income tax deduction for 529 plan contributions up to $5,000 ($10,000 if married filing jointly). In New Mexico, South Carolina, and West Virginia, 529 plan contributions are fully deductible when computing state income tax.

Can you contribute and withdraw immediately?

Most taxpayers are not required to hold funds in a 529 plan for a specified time before claiming a state income tax benefit.

Taxpayers can contribute to a 529 plan, immediately take a qualified distribution to pay for college or K-12 tuition, and qualify for the state income tax benefit. However, Montana and Wisconsin block this state tax deduction loophole by imposing time limits, and Michigan and Minnesota base state income tax benefits on annual contributions net of distributions.

Parents saving for K-12 tuition and adults using a 529 plan to pay for graduate school may get the equivalent of an annual tuition discount by funneling payments through a 529 plan and claiming a state income tax benefit each year.

When are contribution deadlines?

Most states require 529 plan contributions by December 31 to qualify for a state income tax benefit. However, taxpayers in 8 states have until April to make 529 plan contributions that qualify for a prior year income tax deduction.

Who can claim 529 tax deductions?

States typically offer state income tax benefits to taxpayers who contribute to a 529 plan, including grandparents or other loved ones who give the gift of college. However, only the 529 plan account owner (or the account owner’s spouse) may claim a state income tax benefit in seven states.

Eligible taxpayers may continue to claim a 529 plan state income tax benefit each year they contribute to a 529 plan, regardless of the beneficiary’s age. No time limits are imposed on 529 plan accounts, so families may continue contributing throughout the child’s elementary school, middle school, high school, college years, and beyond.

Should state tax benefits determine which 529 plan you choose?

State income tax benefits should not be the only consideration when choosing a 529 plan. Attributes such as fees and performance should always be considered before you enroll in a 529 plan.

In some cases, the better investment performance of another state’s 529 plan (where earnings are compounded) can outweigh the benefits of a state income tax deduction. Use our 529 plan comparison tool to evaluate your options.

Key Takeaways

- No federal deduction: 529 contributions are never deductible on your federal tax return

- State benefits vary: 30+ states offer deductions or credits, with amounts ranging from a few thousand to unlimited

- Tax parity states: Nine states allow deductions for any state’s 529 plan

- Who can claim: Most states allow any contributor (parents, grandparents, friends) to claim the deduction

- December 31 deadline: Most states require contributions by year-end, though six states extend to April

- Beyond tax benefits: Consider fees, performance, and investment options when choosing a plan

Frequently Asked Questions

Do 529 contributions reduce my taxable income?

529 contributions do not reduce your federal taxable income. However, they may reduce your state taxable income in states that offer a deduction or credit. The amount varies by state—for example, Colorado allows you to deduct $20,700 per taxpayer per beneficiary, while Connecticut allows a maximum of $5,000 ($10,000 if filing jointly).

Are 529 contributions pre-tax or post-tax?

529 contributions are made with post-tax dollars. You’ve already paid federal income tax on the money before contributing it to a 529 plan. The tax benefit comes from tax-free growth and tax-free withdrawals for qualified expenses, not from a pre-tax contribution.

Can I deduct 529 contributions to an out-of-state plan?

It depends on your state. Nine tax parity states—Arizona, Arkansas, Kansas, Maine, Minnesota, Missouri, Montana, Ohio, and Pennsylvania—allow you to deduct contributions to any state’s 529 plan. Most other states only offer tax benefits for contributions to their own state’s plan.

Are 529 contributions tax-deductible for grandparents?

Yes, in most states. Grandparents and other non-account-owner contributors can typically claim state tax deductions for their 529 contributions. However, seven states only permit the account owner (or spouse) to claim the deduction. Check your state’s specific rules.

How do I claim my 529 state tax deduction?

You claim your 529 state tax deduction when filing your state income tax return. Most states provide a specific line or form where you report your 529 contributions. Keep records of your contributions throughout the year, including account statements showing deposits. Your state’s tax instructions will guide you through the process.

What happens if I contribute more than my state’s deduction limit?

You can only deduct up to your state’s annual limit in any given year. However, some states allow you to carry forward excess contributions to future years. For example, Virginia allows unlimited carryforward of contributions exceeding the annual $4,000 limit. Check your state’s rules for carryforward provisions.