Students may use a 529 plan to pay for online classes offered through at an eligible institution. Taking online classes is a popular way to save money on college tuition. According to data from the 2015-16 National Postsecondary Student Aid Study (NPSAS), nearly 43% of college students surveyed took at least one distance education course.

Benefits of online courses

Online courses offer greater flexibility than traditional college classes and are offered to full- or part-time students. High school students may take online college courses through a dual-enrollment program if they meet certain requirements. College students may take some courses online to fulfill requirements for a degree or advanced degree program and adults may take online courses as part of their continuing education.

If a student plans to transfer credit from an online course, they should first make sure that the college they are transferring to will accept the transfer. In most cases, colleges do not accept transfer credits from an unaccredited online program. Students can check to see if a college is accredited by using the U.S. Department of Education’s accreditation database. Some colleges will only accept transfer credits from an accredited college if the credit is related to a major degree program.

Even when an online course is from an accredited college, some colleges will not provide transfer credit for the course because it is not quite the equivalent of a course at the college or you didn’t get good enough of a grade in the class. Or, if they do accept it for credit, it will just be general credit that doesn’t satisfy any prerequisites.

How much do online classes cost?

Online courses are typically much cheaper than traditional college courses. A study from U.S. News and World Report shows the average total cost of in-state tuition for an online bachelor’s degree program was $36,961, or $305 per credit hour. The average cost to attend a public in-state 4-year college is around $20,000 per year, or $667 per credit hour.

Students can also save money on transportation and room and board costs if they choose to live at home with parents while taking online courses. However, they may be responsible for other expenses, such as technology fees, high-speed internet access, lab fees and fees for official transcripts and graduation.

Using a 529 plan to pay for online courses

Students can use a 529 plan to pay for online courses if the tuition and fees are paid to an eligible institution. An eligible institution is a college or university that is eligible for Title IV federal student aid. Eligible institutions are accredited, have signed a program participation agreement with the U.S. Department of Education and satisfy a long list of other requirements concerning financial and administrative capability.

Tuition and required fees for online courses are considered qualified 529 plan expenses when they are required for enrollment or attendance. A student can be enrolled full-time or part-time and they do not have to be seeking a degree. For example, parents may use their child’s leftover 529 plan funds to pay for their own continuing education.

A 529 plan can also be used to pay for other expenses, besides tuition and fees, including:

- Textbooks

- Supplies and equipment

- Computers and internet access

- Room and board costs, but only if the student is enrolled at least half-time and pursuing a degree or certificate program

- Student loans

Taxpayers who claim the American Opportunity Tax Credit (AOTC) or Lifetime Learning Credit must subtract the amount of qualified expenses used to justify the credit before taking a 529 plan distribution to avoid double-dipping the tax benefits.

Scholarships and financial aid for online courses

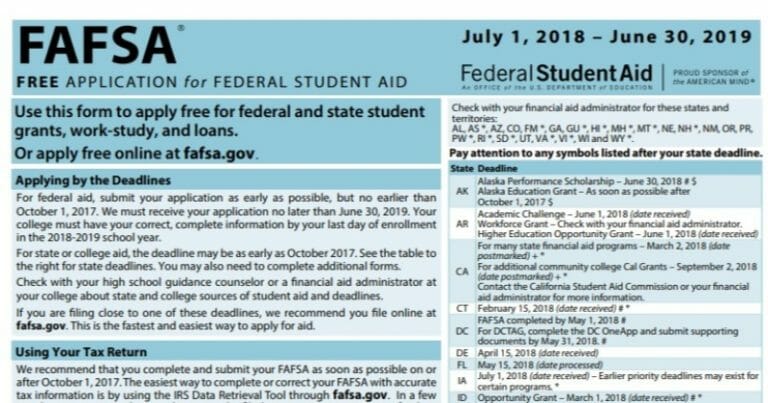

Students who take online courses at an accredited college or university typically have the same eligibility for scholarships and financial aid as they would have at a traditional college. There are also specific scholarships available for students who take online courses.

Adults who are pursuing online certificates, career training, advanced degrees or other professional development may be eligible for employer paid tuition assistance. Eligible expenses for tax-free tuition assistance include tuition, fees, textbooks, supplies and equipment.